This is a question that is on the lips of many people in the country. This must be the second most frequent question that I get asked. The residents of Caldecote in particular, have reason to ask why council tax has gone up so much for them. The question came up again from a member of the Caldecote Facebook Group as shown in the snippet:

As I replied at the time, it would be very easy for me to have given a politically correct answer, but as people in my villages know, I do not subscribe to political correctness in matters such as these. So, here’s the answer I gave, setting the context as simply and clearly as I could.

Composition of Council Tax

The council tax that we pay is made up of 3 main parts namely:

- The Parish Council precept

- The District Council precept

- The County Council precept, which in itself comprises of three elements as follows:

- Fire Authority

- Police Authority

- County council

The total sum of all these is what makes up the council tax that residents get billed for each year.

Council Tax is compared between authorities using the Band D rate and the calculation of the other tax bands is based on set ratios compared to Band D. The ratio is as shown in the table below:

|

Band |

A |

B |

C |

D |

E |

F |

G |

H |

|

Ratio |

6/9 |

7/9 |

8/9 |

9/9 |

11/9 |

13/9 |

15/9 |

18/9 |

Billing Authority

The council tax is collected by South Cambridgeshire District Council (SCDC), which is called the billing authority. SCDC sends out the annual council tax bill, collects the money, then transfers the council and parish precepts to those authorities.

County Council Precept

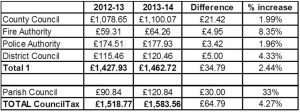

In 2012, the County Council budgeted for an increase in council tax by up to 2.95% every year until 2016-17 municipal year. However, the increase for 2013-14 is 1.99% or £21.42 for a Band D property.

The Fire Authority increased its precept by 8.35% or £4.95, whilst the Police Authority precept increased by 1.96% or £3.42. The complete figures are shown in the comparison table below.

South Cambridgeshire District Council Precept

SCDC has kept its element of the council tax the same for the last two years. In return, it received a “freeze grant” from central government in lieu of raising the council tax. However this year, the Conservative administration decided to increase council tax by 4.33% or £5 for a band D property.

At the meeting of the full council on 28th February 2013 where the council budget was discussed, I voted against the increase, instead backing an alternative proposal which sought to freeze the council tax for one more year, take the freeze grant being offered by central government in lieu, and use some of the surplus £7m sitting in council reserves to make up any shortfall.

It is worth noting that the majority Conservatives voted for the increase, whilst the Deputy Leader and Finance Portfolio holder Cllr Simon Edwards maintained that the money in the reserves was for a “rainy day”. Well, if this current financial crunch for families is not a rainy day, I don’t know what is. Their view, expressed clearly by the Leader Cllr Ray Manning is that, afterall it is only £5, which is not a lot. The one element that seemed to have been omitted from their deliberation is that families already have increased cost of living, and this is just another burden they don’t need at this time.

Parish Council precept

Caldecote Parish Council at its meeting of 1 November 2012 considered its budget forecast for the year 2013-14, and proposed a precept increase of £30 per band D property, pro-rata for the other bands. This was a 33% increase on the current precept of £90. The final budget was considered and accepted at the meeting of 3rd January 2013, and the precept request was accepted and made to South Cambridgeshire District Council, the billing authority. The minutes of the parish council meetings for November 2012, December 2012 and January 2013 which recorded these events can be found at http://www.caldecote.gov.uk/minutes.

Caldecote Parish Council at its meeting of 1 November 2012 considered its budget forecast for the year 2013-14, and proposed a precept increase of £30 per band D property, pro-rata for the other bands. This was a 33% increase on the current precept of £90. The final budget was considered and accepted at the meeting of 3rd January 2013, and the precept request was accepted and made to South Cambridgeshire District Council, the billing authority. The minutes of the parish council meetings for November 2012, December 2012 and January 2013 which recorded these events can be found at http://www.caldecote.gov.uk/minutes.

To put the Caldecote precept in context, the average parish precept for the 100 precepting villages in South Cambridgeshire district is £73.55. Cambourne precept is £120.75, Comberton is £62.08, Hardwick is £56.06, Kingston is £70.85 and Toft is £71.43 (the last two being in the Caldecote district ward). The Caldecote precept is the highest in South Cambridgeshire. The increase has also meant that Caldecote residents are paying the highest council tax in the whole of South Cambridgeshire.

The table below shows the Council Tax Rates for Band D Property for easy comparison

.

As I am not a Parish Councillor and was not party to any of the discussions on the precept nor on the decision, I am not in a position to explain why there was such a large increase. If anyone wishes any further clarification, then I suggest they contact the parish council chairman or email the parish clerk parishclerk@caldecote.gov.uk.

Caldecote parish council holds its monthly meetings at 8pm on the first Thursday of each month, at the Caldecote Pavilion on Furlong Way. Members of the public can attend and ask any question they wish during the open session at the meeting. The agenda is normally listed on the agenda page of the parish council website

Conclusion

In conclusion, the council tax has increased in order to enable the various arms of local government to raise funds to provide the services they need to provide to residents in their areas.

The largest increase this year has been the Caldecote parish precept at 33%, but overall increase in council tax is £64.79 or 4.27% compared to the tax for 2012-13.