Council Tax for an average Band D home in South Cambridgeshire is £165 for this municipal year 2023-24. It is one of the lowest charges in the country, increasing only at 3.4 per cent, or 10 pence a week from the level of charge in the previous year. This is in complete contrast to misleading information recently published in some national newspapers.

What is Council Tax

Council Tax is an annual fee your local councils charges you for the services they provide. It helps pay for the work of local councils, security and emergency services. The charge is normally paid by households in residential properties directly to the District Council.

How is Council Tax Calculated

In South Cambridgeshire, there are four layers of local government and two public bodies. These are:

- parish councils

- South Cambridgeshire District Council (SCDC),

- Cambridgeshire County Council (CCC)

- Cambridgeshire and Peterborough Combined Authority (CPCA).

- Cambridgeshire Police

- Cambridgeshire Fire Authority

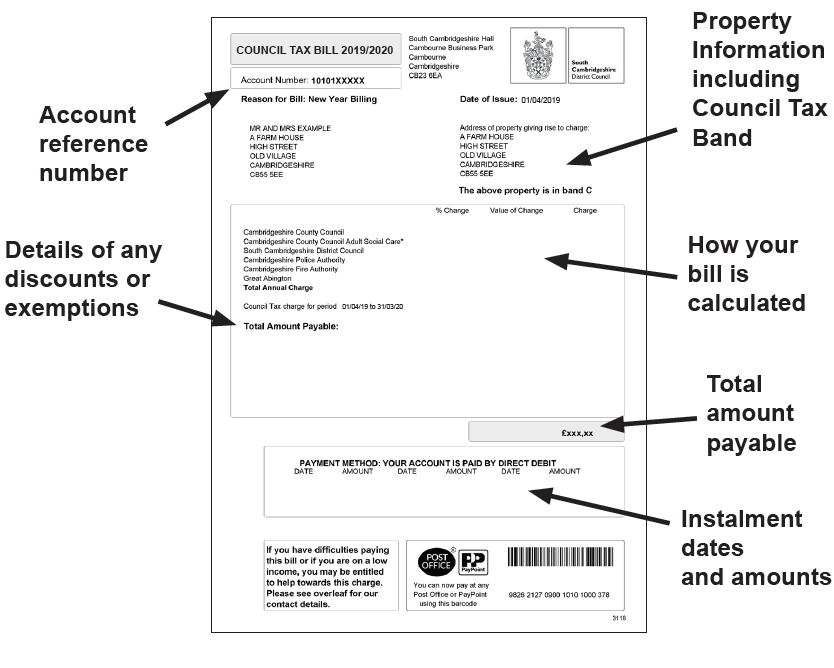

Each of these bodies sets its own annual council tax commonly known as precepts, according to its needs for the services they provide. Then these authorities forward their precepts to the District Council to collect on their behalf. So your Council Tax bill from SCDC is the total of the precepts for all the Councils and two public bodies. This is shown in the example diagram above. SCDC only keeps its share and forwards all the other precepts to each charging authorities.

What is South Cambridgeshire Council Tax

There’s a lot of misleading information being given in national newspapers about the amount of Council Tax being charged by South Cambridgeshire District Council. As explained above, SCDC collects its own and on behalf five other authorities. It therefore only retains a small amount of the Council Tax it collects.

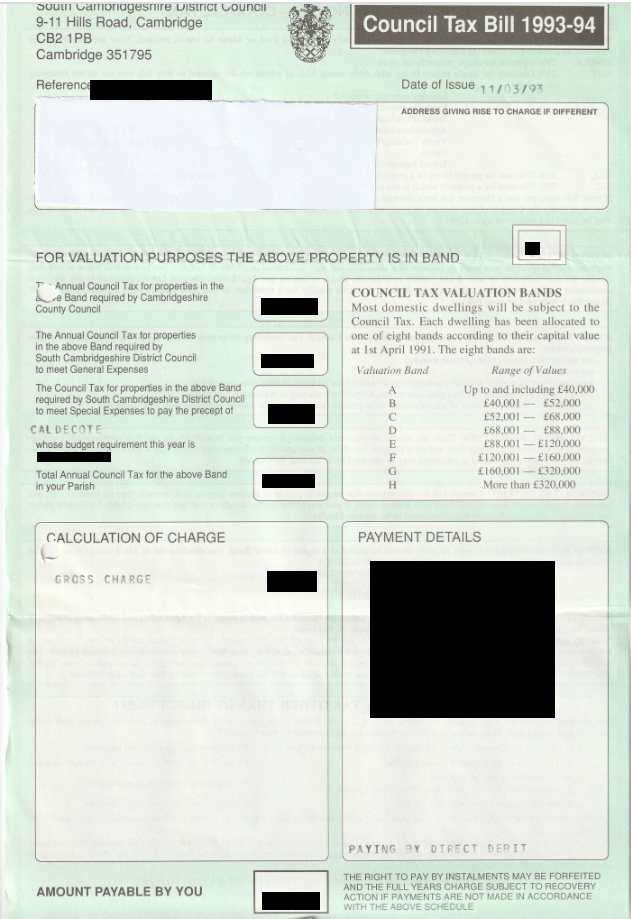

The false allegations are comparing the tax collected back in 1993/94 to what is collected now, 30 years later. However, those misrepresentations fail to take into account the difference of the monies collected and what portions it is comparing. The example from 1993/4 shows only 3 precepts in the bill, namely Cambridgeshire County Council, South Cambridgeshire District Council and the Parish Council. This is half the number of precepts that the Council Tax bill of 2023/24 shows. This therefore puts the comparisons by the pressure group into question.

Band D Council Tax

For the 2023/24 municipal year, the South Cambs council tax precept for the average Band D property is £165. This is 9 per cent of the amount of the council tax bill. This is £5 higher than the figure for last year, as the council limited the increase to 3.4 per cent, or 10 pence a week for all properties. This figure is one of the lowest council tax charges in the country. Infact, in the league table for 2023/24 the council is 138 out of 164, so nowhere near charging the highest Council Tax in the country as alleged. South Cambridgeshire District Council is not immune from the cost-of-living crisis. It also must face inflation for the goods and services it buys, but although it faced a 10 per cent rise in these costs, its Council Tax rise was kept to 3.4 per cent.

This year the Council Tax you pay to South Cambridgeshire amounts to £11.23 million in total. But the cost of running the council is £55.5 million, showing that what you pay accounts for about one fifth of what the council needs to deliver your services. The rest comes from Business Rates, fees and charges, grants for specific things, commercial investments, and national government. To see how the £55.5 million is spent refer to the South Cambs magazine or the council website.

Conclusion

The real council tax bill for South Cambridgeshire District Council is still one of the lowest in the country. The national newspapers trundling out misrepresentations about council tax increases over a 30 years period are supporters of the Conservative Party. Since the Liberal Democrats are their challengers in South Cambridgeshire, and there is likelihood of a General Election in the near future, we can expect more of this misinformation. Do me a favour and check the facts with us directly. Thank you.