Council tax is levied on every residential property, owned or rented in the country which helps to pay for a wide range of local services including refuse collection, policing, social care and more. South Cambridgeshire collects council tax on behalf of all the local authorities. Central government records the amount of council tax due and collected by every council in the country and publishes this every year. South Cambs have had high rates of collection and have maintained that again this year as new tables show.

Council Tax collection

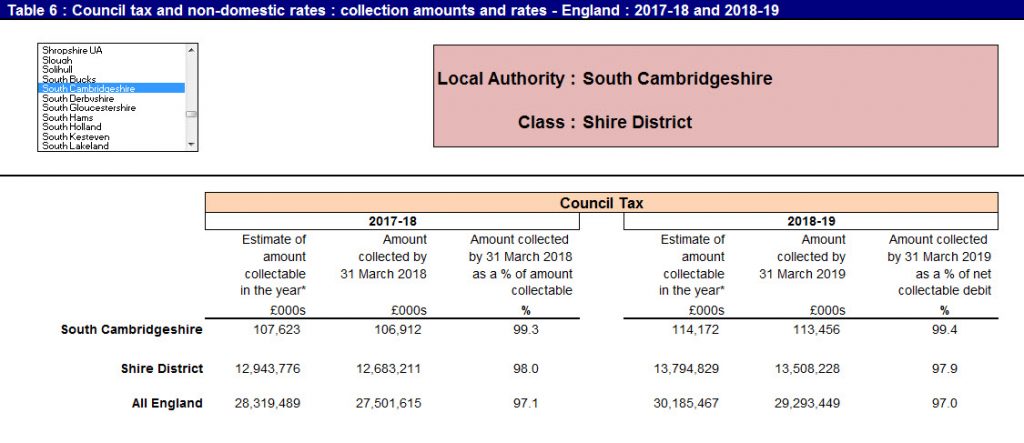

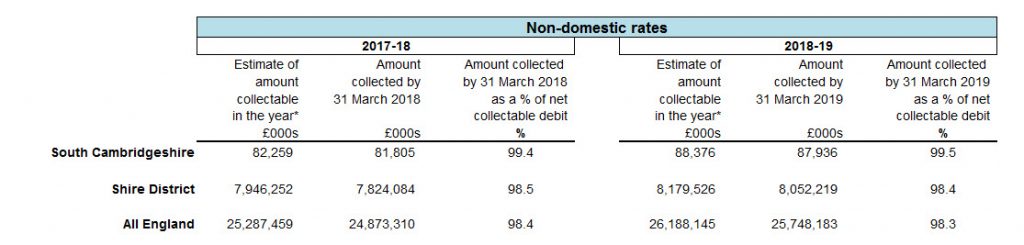

National league tables showing local councils’ rates of collection for Council Tax and Business Rates were published recently on the government website, showing that South Cambridgeshire District Council retained its top three position among more than 300 Councils in England.

With the percentage collection rate for Council Tax hitting 99.4%, the Council has slightly improved on last year’s rate of 99.3%. From total Council Tax due of £114.2 million – which is collected on behalf of the Police and Crime Commissioner’s office, the Fire Authority, Cambridgeshire County Council and local parish councils as well as South Cambridge District Council – the team ended the financial year with just £716,000 outstanding.

Non-Domestic Business Rates collection

For Business Rates, the Council’s position showed a marked improvement – from 26th nationally out of 326 councils to 16th. Although not securing a top 10 position, the Business Rates collection rate was even better than that of Council Tax, at 99.5% with just £404,000 outstanding at the end of the financial year, from a total charge of nearly £88.4 million.

Council House Rent Collection

High performance for collection of Council House Rents was also recognised, as the Council secured second place from those authorities that provided data, with around 98.5% of the £28 million annual rent charge being collected by the end of the year. As with all collection areas, work continues to collect any balances remaining.

Staff Recognition

Finance bosses have thanked staff for their consistent hard work and high standards and recognised that this level of performance is also made possible thanks to residents and businesses across South Cambridgeshire who regularly pay their council tax and business rates on time, in turn providing funding for essential services across the district.

Cllr John Williams, South Cambridgeshire District Council’s Lead Cabinet Member for Finance, said: “The team’s consistent high performance over a number of consecutive years is a credit to the Council as well as our communities. Council Tax funds such a wide range of vital services – everything from our recycling and waste collections to our fire crews and police – and all of these services rely on everyone in the community paying their Council Tax.

“We are always trying to improve efficiencies to make it easier for people to pay and householders can now access their Council Tax accounts securely online. People can view and print their latest bills, sign up to receive future bills electronically, check their payment history and balance, and set up a new way to pay, such as by Direct Debit.

“We do understand however that it’s not always easy for some households or smaller businesses to balance their budgets. So, while we are proud of our high collection rate, we always encourage anyone who might be finding it difficult to make payments to get in touch with us. We may be able to offer support or guidance, and it is always better to do so sooner rather than later, before debts have begun to get out of hand.”

Help for Businesses

There are a number of discounts available both to businesses and householders, and anyone wishing to find out more about the available reductions/discounts should visit the Council’s website.

For Business Rates: www.scambs.gov.uk/business-rates/business-rates-reliefs-and-exemptions.

For Council Tax: www.scambs.gov.uk/council-tax/reductions-and-discounts.

For Housing Benefit and Council Tax support: https://www.scambs.gov.uk/benefits.

For general Council Tax information: https://www.scambs.gov.uk/council-tax/.

Please share with anyone you know who might benefit from this information.